Pension lump sum tax calculator

Investors can avoid taxes on a lump sum pension payout by rolling over the proceeds into an individual retirement account IRA or other eligible retirement accounts. You may have to pay more tax depending on the size of the lump sum you withdraw.

How Do I Calculate The Value Of A Pension Financial Samurai

Look at the lump-sum offer in the context of your entire financial picture.

. Our calculators havent yet been updated to reflect the changes being. 2 days agoTax-free cash is one of the main benefits of pension saving with most pension savers being able to take 25 per cent of their pension value as a lump sum says Gary Smith financial planning. Most DB plans offer the option of a one-time lump sum payment or monthly benefit payouts.

Take an honest look at your health and family history of longevity before you make your. FAQ Blog Calculators Students Logbook Contact LOGIN. An easy-to-use and hassle-free tool Post Office National Pension Scheme Calculator calculates the lump sum amount to be received just by entering a few basic details related to the scheme.

20 40 and 45 tax relief is available on contributions. Lump Sum Payout Calculator branded for your website. Once the full 25 tax-free portion is taken out the maximum tax relief available on money you pay into your pension falls to 4000 a year.

R Rate of interest per. Unless the pension pot is very small this is almost always a bad idea from a tax point of view. This calculator has been updated for the and 2022-23 2021-22 and 2020-21 tax years.

If you have reached age 75 and have insufficient lifetime allowance this percentage will be lower. On the flip side a lump sum is fully in your control should you want to include that amount in your estate planning. This will mean that the maximum youll be.

But if you take an uncrystallised fund pension lump sum youll trigger something called the money purchase annual allowance. Sorry to do this to you but the best answer is. Downsides of taking out a lump sum.

Lets continue with the example above. The type of pension payout you elect. However it is possible to cash in an entire pension pot as a single lump sum.

FV P 1 rn nt. Conversely the shorter your life the more valuable the lump sum. SARS Retirement Fund Lump Sum Tax Calculator Work out Tax Payable on Pension Provident and Retirement Annuity fund lump sums.

This calculator assumes that all assumptions remain steady and predictable over time. Our free pension tax relief calculator shows how much you could receive this tax year 20152016. How to Avoid Taxes on a Lump Sum Pension Payout.

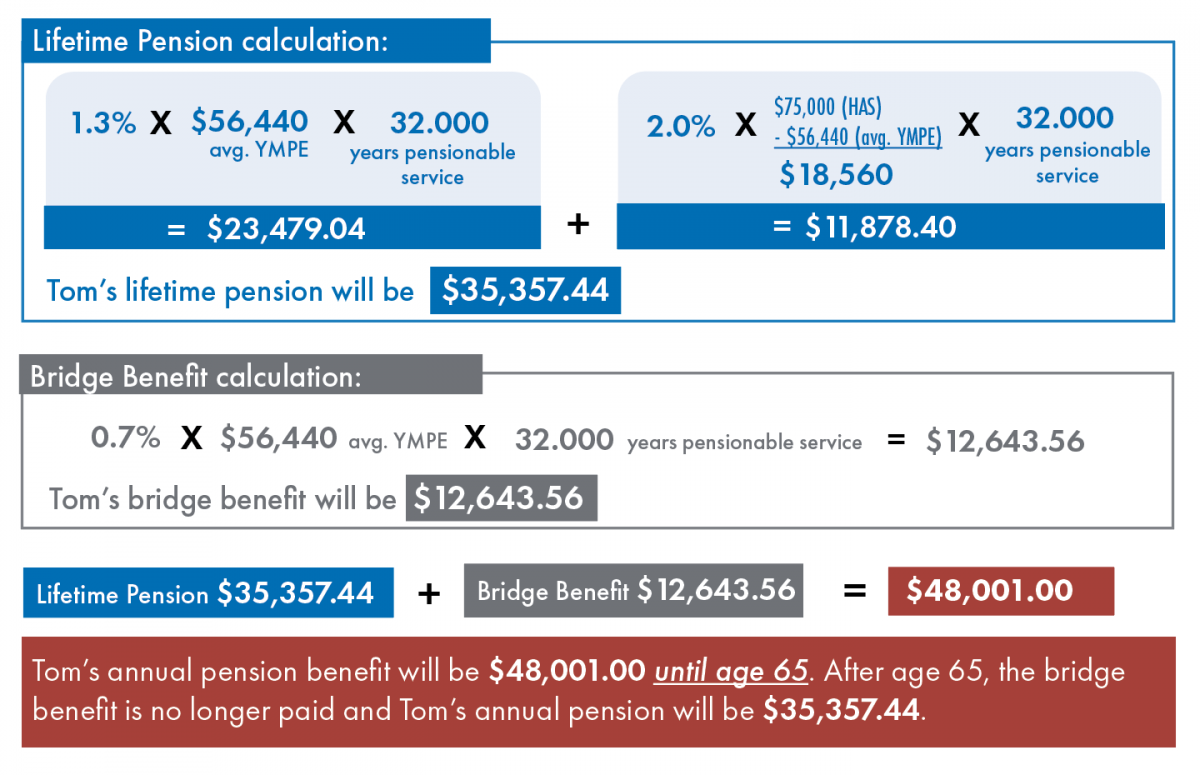

The lump-sum payment is when you receive one large cash payment from your pension plan instead of receiving your pension in monthly installments. The maximum tax free lump sum that you may be entitled to receive. Monthly Pension Payment X 12 Lump Sum Offer X 100 Annual Return Needed on Lump Sum in Percent Form As an example consider a scenario in which a retiree is asked to choose between 1000 a month for life beginning at age 65.

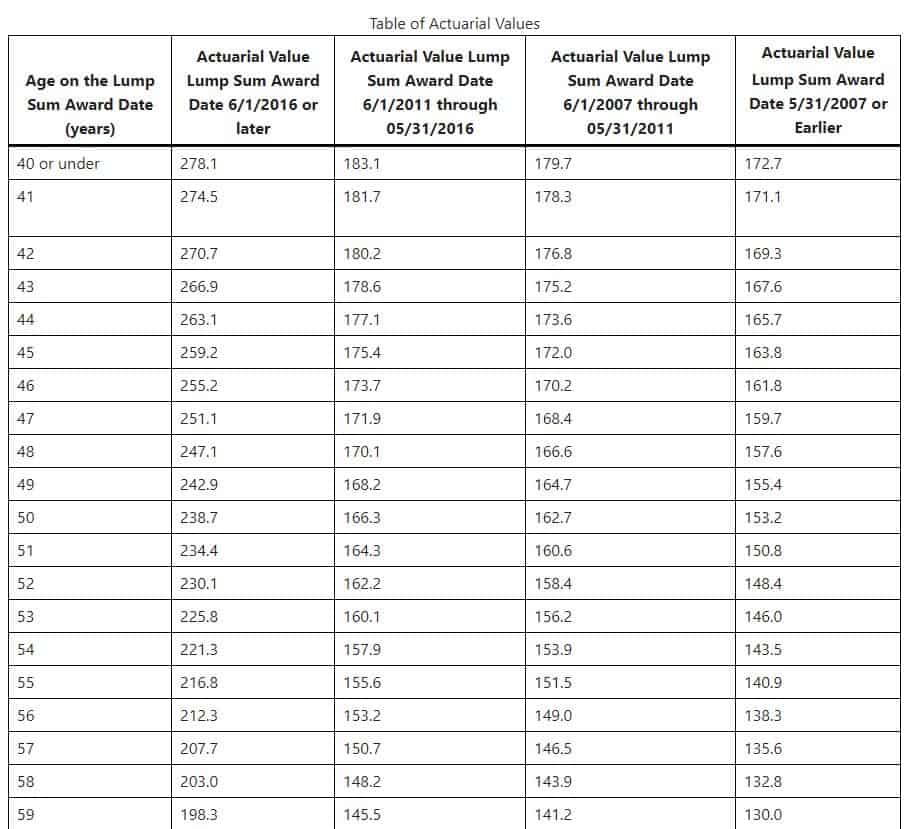

Here FV Final Value. In the context of pensions the former is sometimes called the commuted value which is the present value of a future series of cash flows required to fulfill a pension obligation. If you take the lump sum the longer you live beyond 20 years the higher your annual return will need to be to match the lifetime income payments.

If youre only taking the 25 tax-free pension lump sum youll still be able to contribute up to 40000 a year into a pension and earn pension tax relief. Use this calculator to compare the results of getting a lump sum payout instead of a guaranteed monthly pension for life. Here are two things you need to know.

Think of it as a buyoutyour employer is trying to get out from its future pension obligations by giving you one big payment now. Use the Tax year dropdown to select the one you want. Get a Pension vs.

This calculator cannot predict your final superannuation benefit or level of retirement income with certainty because this will depend on your personal circumstances unexpected life events the age pension paid investment earnings tax and inflation. Use our fund benefit calculator to work out the tax payable on lump sum payments from Pension funds Provident funds andor Retirement Annuity funds. Here we answer some of the common questions around taking a tax-free lump sum.

In fact the sooner you can invest your lump sum the more time it will have to grow potentially giving you more income in retirement. A pension is a tax-efficient way to put money aside for later in life to provide income for when you retire. How much tax will I pay on my pension lump sum.

Even if you plan on rolling over your pension payout some companies withhold. Colorful interactive simply The Best Financial Calculators. To find out how this works in detail you can read our guide Should I take a lump sum from my pension This calculator will help you figure out how much income tax youll pay on a lump sum this tax year.

Of course the longer you live the more valuable the monthly pension is worth. The maximum amount of basic pension that you would sacrifice in order to take the maximum lump sum. Most people choose a monthly payout also known as a life annuity Having that steady income can make for less.

P Principal Sum. That tax payable on a pension lump sum is the same as a regular pension contribution. Youll receive pension tax relief on pension contributions up to 100 of your salary up to an annual threshold of 40000.

At age 55 you can access your pension and take a lump sum which may be subject to income tax. Here is the compound interest formula to compute the NPS amount. Generally the first 25 of your pension lump sum is tax-free.

This is called the Money Purchase Annual Allowance. One thing to note. You can take 25 per cent of any pension pot as a tax-free lump sum.

The calculations assume that 25 of any lump sum from a non-drawdown pension is available tax free.

Form 2 Common Nomination Form For Gratuity And Cgegis Ccs Payment Of Gratuity Under Nps Rules 2021 In 2022 Rules Group Insurance Nps

3 Ways To Calculate Retirement Benefits In Kenya Wikihow

Pension Calculator Pensions Calculator Words Data Charts

Strategies To Maximize Pension Vs Lump Sum Decisions

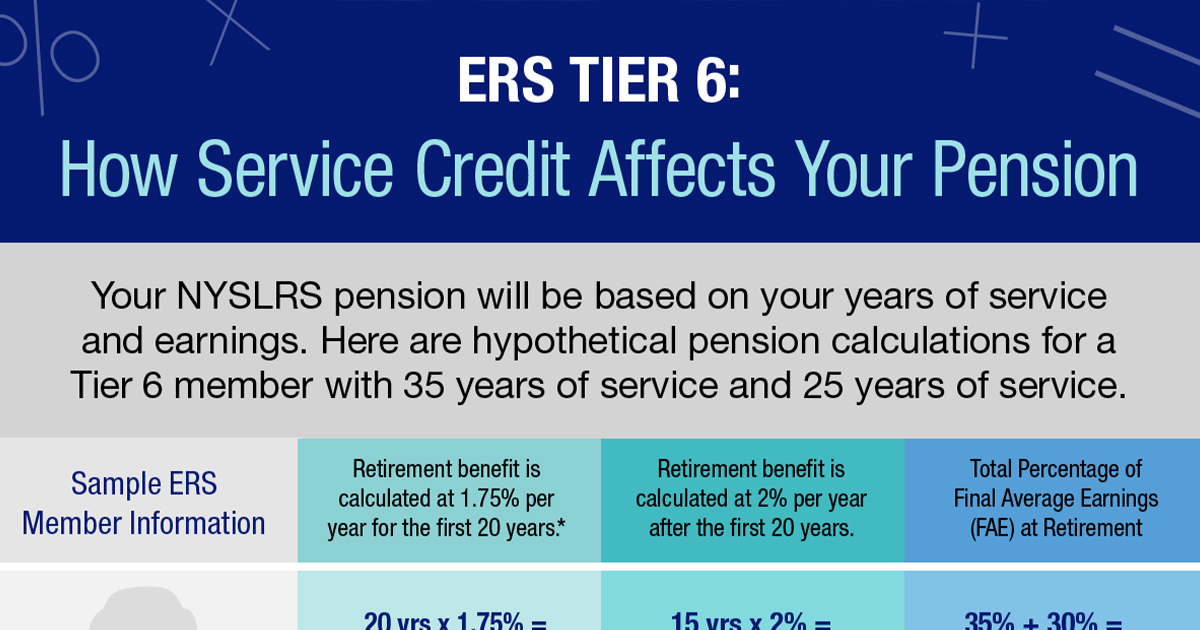

Ers Tier 6 Benefits A Closer Look New York Retirement News

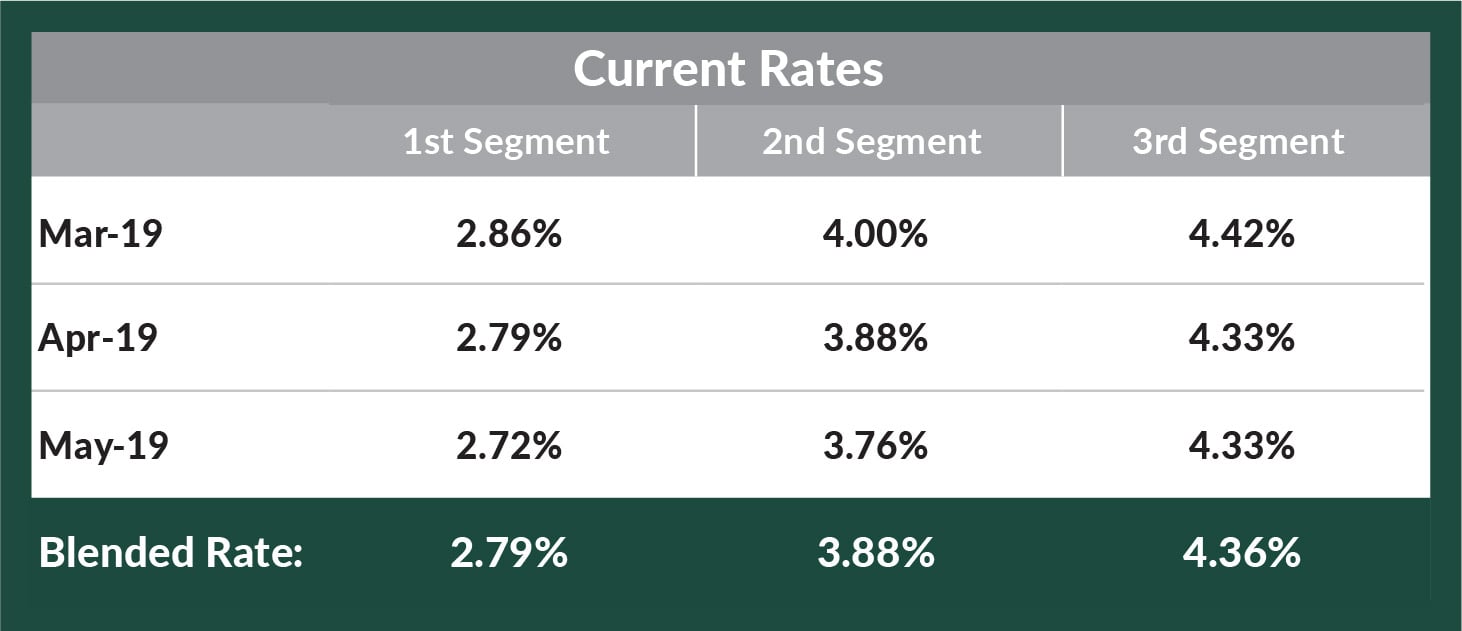

How To Pick Your Retirement Date To Optimize Your Chevron Pension

Tax Withholding For Pensions And Social Security Sensible Money

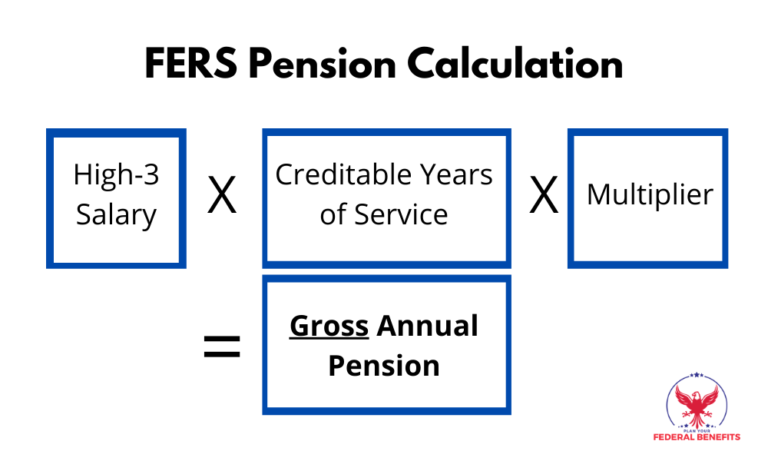

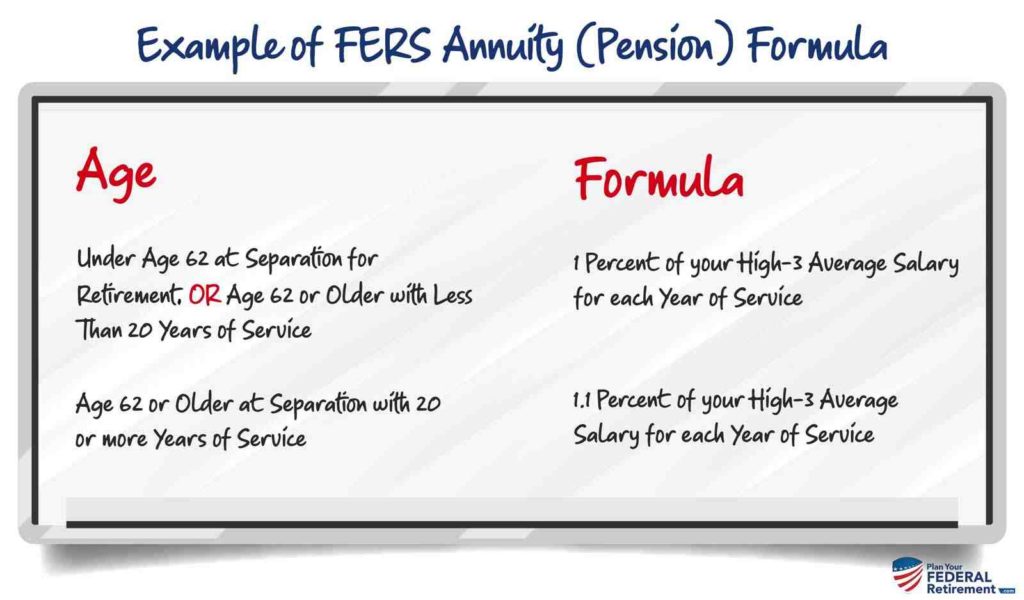

Can I Take My Fers Pension As A Lump Sum Government Deal Funding

How Your Pension Is Calculated Nova Scotia Teacher S Pension Plan

3 Ways To Calculate Retirement Benefits In Kenya Wikihow

Cagr Calculator For Stocks Index Mutual Funds Fd Calculate In 3 Easy Steps Financial Instrument Mutuals Funds Systematic Investment Plan

Tax Withholding For Pensions And Social Security Sensible Money

Retirement Pension Lump Sum Or Monthly Annuity Payment Your Money Your Wealth Podcast 354 Youtube

Social Security Calculating Approximate Amount Of Your Public Pension Anshin Immigration Social Security

Social Security And Lump Sum Pensions What Public Servants Should Know Social Security Intelligence

Pension Calculator 2 2 Free Download

Federal Pension Calculator Government Deal Funding